sacramento property tax rate

Actual property tax rates vary slightly from property to property within cities and counties due to special property tax boundaries. The Sacramento sales tax rate is 1.

332 Blackbird Ln Sacramento Ca 95831 Black Bird Real Estate Professionals House Prices

Did South Dakota v.

. The minimum combined 2022 sales tax rate for Sacramento California is 875. Tax Collection and Licensing. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

The median property tax on a 32420000 house is 239908 in California. Actual property tax rates vary slightly from property to property within cities and counties due to special property tax boundaries. Sacramento Countys average tax rate is 68 of assessed home values slightly less than the state average of 74.

The Sacramento County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Sacramento County and may establish the amount of tax due on that property based on the fair market value appraisal. The 825 sales tax rate in Sacramento consists of 600 California state sales tax 025 Sacramento County sales tax 050 Sacramento tax and 150 Special tax. All groups and messages.

See detailed property tax information from the sample report for 2526 H St Sacramento County CA. Learn all about Sacramento real estate tax. Our Mission - We provide equitable timely and accurate property tax assessments and information.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Learn more About Us. Revenue and Taxation Code Sections 605115 620115.

Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04 folsom city of 24 05 galt city of 26 06 citrus heights city of 29 07 elk grove city of 31 08 rancho cordova city of 36 51 elk grove unified school district outside sacramento city 40 52 folsom. 13 counties have higher tax rates. What is the sales tax rate in Sacramento California.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Calculate your real estate tax by multiplying your propertys assessed value by the annual tax rate. View the E-Prop-Tax page for more information.

Property taxes have customarily been local governments near-exclusive domain as a. Proposition 13 enacted in 1978 forms the basis for the current property tax laws. The median property tax on a 32420000 house is 340410 in the United States.

Sacramento County has one of the higher property tax rates in the state at around 1127. Citizens pay roughly 291 of their yearly income on property tax in Sacramento County. Whether you are already a resident or just considering moving to Sacramento to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

44 out of 58 counties have lower property tax rates. Note that 1127 is an effective tax rate estimate. Funds from these sales tax measures are used alongside local property tax revenues and other funds to pay for infrastructure public safety flood protection and other.

At that rate the total property tax on a home worth 200000 would be 1620. Sacramento county tax rate area reference by primary tax rate area. Note that 1127 is an effective tax rate estimate.

California Property Tax Rates County Median Home Value Average Effective Property Tax Rate Riverside 304500 097 Sacramento 299900 084 San Benito 459700 082 San Bernardino 280200 083. The County sales tax rate is 025. The countys average effective property tax rate is 081.

What Are Sacramento Real Estate Taxes Used For. Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information.

13 counties have higher tax rates. 075 to city or county operations. Sacramento County is located in northern California and has a population of just over 15 million people.

Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls. Based on that rate the average Sacramento County tax bill is about 2204 a year. Revenue and Taxation Code Section 72031 Operative 7104 Total.

44 out of 58 counties have lower property tax rates. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value. California Property Tax Rates County Median Home Value Average Effective Property Tax Rate Riverside 304500 097 Sacramento 299900 084 San Benito 459700 082 San Bernardino 280200 083.

Sacramento County has one of the higher property tax rates in the state at around 1127. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. 025 to county transportation funds.

Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. The California sales tax rate is currently 6. Sacramento County Assessors Office Services.

The median property tax on a 32420000 house is 220456 in Sacramento County. This is the total of state county and city sales tax rates. Its also home to the state capital of California.

If Sacramento property tax rates have been too high for your revenue causing delinquent property tax payments you may want to obtain a quick property tax loan from lenders in Sacramento NM to save your property from a potential foreclosure. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Contra Costa County.

You can print a 825 sales tax table here. In West Sacramento the sales tax rate is 825 percent which includes the state-mandated 725 percent plus four separate ¼ cent voter-approved sales tax measures that fund important local projects.

California Property Taxes Explained Big Block Realty

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Property Taxes Department Of Tax And Collections County Of Santa Clara

Understanding California S Property Taxes

San Diego County Public Records Public Records San Diego San Diego County

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Best Buy Cities Where To Invest In Housing In 2017 Where To Invest Investing Real Estate Investing

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

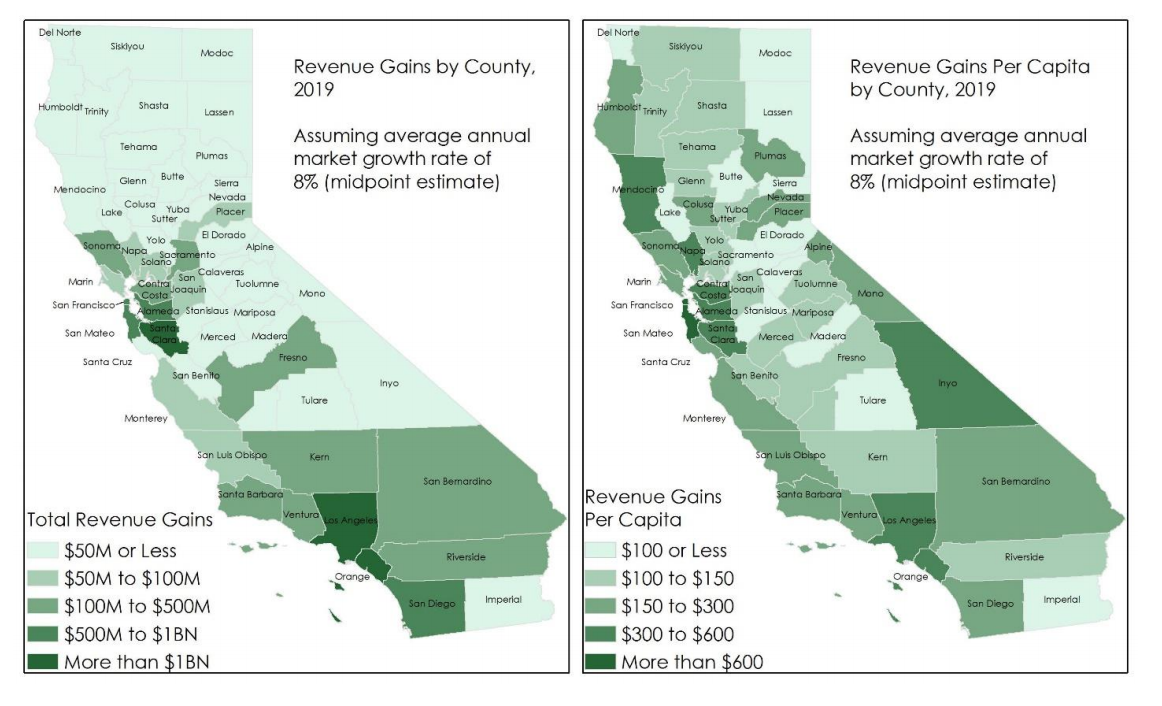

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review

Those Who Have A Better Grasp Of Tax Technicalities And Opportunities For Economic Growth Will Always View Estat Estate Planning Florida Real Estate Estate Tax

Understanding California S Property Taxes

Massachusetts Property Taxes These Communities Have The Highest Rates In 2022 Boston Business Journal

If You Are Renting A Home At 1600 A Month In Sacramento You Could Break Even On That Amount In Only 1 Year And Rent Vs Buy Buying A Condo Las